CRE Forecast: What’s in store for 2023?

By Liz Wolf

As we enter the new year, MNCAR reached out to top Twin Cities commercial real estate executives to gain insight into what 2023 could bring for the sector. We asked these heads of brokerage shops to share what they’re most optimistic about as well as what concerns they have for the industry.

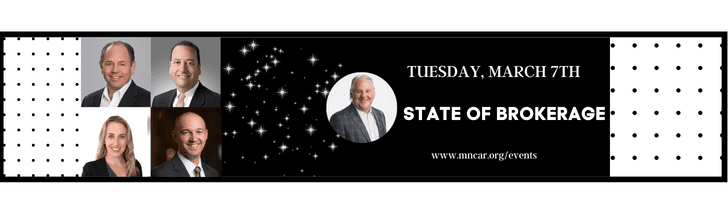

Industry experts are:

Mike Salmen, managing principal of Transwestern’s Twin Cities office

Tate Krosschell, principal and managing director of Avison Young’s Minneapolis office

Jeff Jiovanazzo, managing director for CBRE Minneapolis

Mike Ohmes, managing principal for Cushman & Wakefield’s Minneapolis-St. Paul office

Jim Jetland, principal of Forte Real Estate Partners

These same executives will serve as panelists at MNCAR’s upcoming State of Brokerage 2023 on March 7, where they will share the latest news and trends in the brokerage community.

Here are their thoughts.

MNCAR: What are you optimistic about when it comes to the Twin Cities commercial real estate market in 2023?

Salmen: The resilience of the Twin Cities real estate industry to continually rise to the challenges presented during the past few years as well as those we will face in 2023. Additionally, I’m impressed by how commercial real estate professionals have adapted to the fast-changing market by providing innovative and creative solutions for our clients. Our industry is leading the “return-to-work” effort and will play a critical role in helping our clients create a compelling case for their employees to get back into the office.

Krosschell: The current climate has necessitated that commercial real estate owners and users are being more strategic than ever with their business decisions. I think that means we will be seeing very deliberate, high-quality developments, renovations, and tenant spaces. That also means that the level of service being provided by real estate advisors needs to be of the highest caliber, so we should be seeing the cream really rise to the top.

I also believe there are reasons to be optimistic across all asset types. Industrial development is finally starting to catch up to demand, which will make it easier for tenants to find their ideal spaces. As office users continue to right size, opportunities will open for new, small businesses to move in, and our industry will also be able to get creative with repurposing surplus space. The multifamily sector is ripe for growth considering the shortage of affordable and market-rate housing and the considerable population growth in the downtown area. Restaurants are increasingly popping up downtown, which I believe will continue to attract consumers and investors and bring the energy and excitement back to our city that we saw before the pandemic.

Jiovanazzo: We have seen tremendous activity in the industrial, retail, and multifamily sectors and are confident that demand will stay strong in 2023, even in the face of potential market headwinds.

Jetland: There are several areas or sectors that I am optimistic about in 2023, but if I had to choose one, it would be the healthcare sector. Healthcare certainly has had its challenges over the past few years, including the pandemic, nurses strike, and an overall significant decrease in revenue coming from overall inpatient care in a hospital setting. But what these challenges have created is the opportunity to move services out of the hospitals and into more accessible and affordable community retail settings.

This change in where many of the patient-facing services are performed will provide an opportunity for the commercial real estate sector to benefit from more urgent care locations, specialized clinics, and a more decentralized landscape for healthcare services. Healthcare systems will be forced to have a more focused plan for their real estate strategy moving forward, which will be an opportunity to those that understand this sector and can be proactive in resolving their client’s real estate concerns.

Ohmes: Brokers tend to be optimists, and there are a number of positive signs and trends in Twin Cities commercial real estate as we get into 2023. Overall, fundamentals for industrial and multifamily remain healthy – perhaps, historically so for industrial. Retail, too, has made a tremendous rebound since the depths of the pandemic, especially experiential retail.

Industrial real estate is 3 percent vacant, 30 basis points and 40 basis points lower than the national and Midwest averages, respectively. While we ended 2022 with nearly 8.2 million square feet in the development pipeline, roughly 41 percent of that is preleased or will be owner-occupied. That said, we may see new speculative development delayed or converted to build-to-suit sites as developers work through financing challenges, increased construction costs, and end-users’ evolving timelines.

From a multifamily investment perspective, price-per-unit increased year-over-year in 2022 from $187,000 per unit to $217,000 for Twin Cities apartment buyers. Tenant demand should remain healthy, too, as spreads have widened between the cost of a home mortgage and monthly rents.

For the office sector, we expect investment sales to rebound, though not quite back to 2018 levels. We’ve seen a number of investors and developers successfully execute upgrades to their office buildings and, in turn, attract tenants in their flight to quality and a reimagined workplace. Last year’s $1.3 billion in office transactions exceeded 2021 volumes by 49.3 percent. What’s more, well capitalized investors are poised to compete for assets where they may have been priced out a few years ago.

What do you see as the biggest challenges the industry could face this year?

Salmen: Declining office space demand caused by remote/hybrid work as well as the economic headwinds our industry is facing, specifically rising interest rates and low unemployment. I am also very concerned about the safety issues in both downtown Minneapolis and St. Paul — some perceived and some very real. Our city leaders need to acknowledge the problems and take immediate actions to remedy the situation before it’s too late.

Krosschell: Unsurprisingly, I think the biggest challenges will continue to be high interest rates and inflation, which has caused a big slowdown in capital markets activity and institutional investments. We’re once again seeing deals be put on hold or cancelled due to these lending conditions and ongoing uncertainty.

Industrial development will have to slow down as developers reevaluate the demand in our market, and leasing volume will surely decline during that period. I think the demand for office space will remain low, property values will suffer, and decisions about what to do with all the excess space will be slow to develop. Multifamily rents will likely remain flat given the high supply, government policies, and lingering safety concerns downtown. And our industry will also have to get creative with how to repurpose some of the large retail spaces that major tenants have recently vacated.

On a new talent front, I think our industry has fallen behind in how it attracts and pays young talent, and it’s becoming more challenging to find and keep good candidates. I think we collectively need to reassess how we approach recruiting if we want to compete with other industries for top, diverse talent.

Jiovanazzo: The office sector recovery is progressing at a slower pace as employers face challenges from the pandemic and with public safety in downtown Minneapolis. Wage inflation has become a critical factor for businesses, and going forward, labor will be a concern, which along with headcount, will be a major focus for companies in 2023 with ripple effects for jobs and real estate. Additionally, as brokers, we need to be prepared to deliver more comprehensive advisory services to clients as our current environment is complicated to navigate.

Jetland: I believe the office market is going to see the most negative impact in 2023. Most companies in the office sector are considering less space when their current lease expires. On average, I suspect many office users have 20 percent to 40 percent of excess space due to the increase in working from home, a significant change of employees’ work habits. While I don’t expect everyone will work only from home in the future, the expectation is that many office workers will only be in the office two to three days per week. This trend is likely here for the next three to five years and possibly beyond. I expect we will see both a significant reduction in many companies’ office requirements combined with shorter leases and more flexible lease terms that include termination options and downsize options.

The news is not all bleak for the office sector. There will be winning properties that come out of this challenging time as we see more tenants pursuing a flight to quality. But in the overall office market, the balance of power will shift more in the direction of the tenant and away from the landlord.

Ohmes: Uncertainty around credit markets poses one of the biggest challenges, and that impacts both corporate real estate decision makers and real estate investors. Organizations and investors can operate in a higher interest rate environment, but it has an impact on underwriting and values. They just need to have the confidence that market volatility has subsided so they can make informed decisions and change underwriting assumptions on pricing, leasing economics, access to credit and other factors.

Overall, the Twin Cities office market faces its own set of challenges. We’ve discussed return-to-office for a couple of years now. Employers’ ability and willingness to meet employees’ expectations and implement new workplace design and amenity programs to boost office utilization has had mixed results. This is especially crucial in our CBD, where daytime workers play such an important role in supporting local small businesses, retail, and restaurants and boosting an overall sense of security and vitality. It also has a tremendous impact on building valuations and the ability to obtain financing, as well as questions around local taxes vs. an asset’s worth. In the Twin Cities, we have $1.1 billion in CMBS loans with maturity dates in 2023, according to Trepp, adding another layer of complexity and concern regarding potential delinquencies.